The cup and handle pattern stands as a secret weapon for savvy investors. Yet, this powerful pattern doesn’t unfold overnight; it’s a game of patience, a journey of prolonged accumulation. The sweet fruits of success await those who understand the art of waiting. In this exploration, we embark on a detailed journey into the fascinating world of the cup and handle pattern.

What Is the Cup and Handle Pattern?

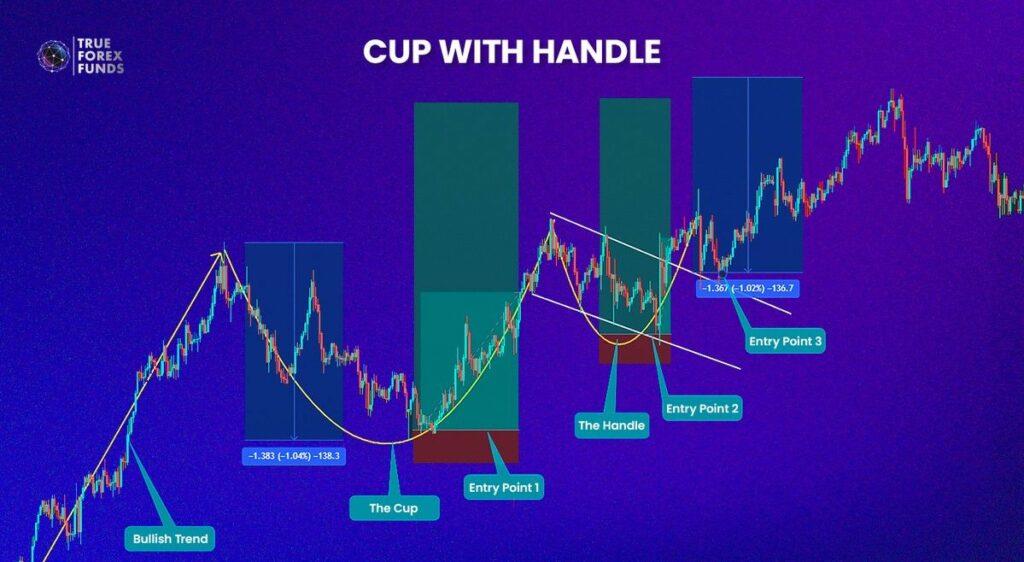

Imagine you’re checking the price movements of currency pairs on a forex chart. Now, think of the cup and handle pattern as a shape that can show up on this chart, resembling a cup with a handle, like a coffee mug. The cup part looks like a “U,” and the handle slants a bit downward.

Now, why is this interesting for forex traders? When this cup and handle shape shows up, it’s often seen as a bullish sign, where the exchange rate might increase soon. This pattern was popularized by William O’Neil in his 1988 book, ‘How to Make Money in Stocks.

This pattern can form relatively quickly, in about seven weeks, or it might take a longer time, up to 65 weeks. For forex traders, spotting a cup and handle signals an upward surge in the exchange rate, so it’s time to pay attention!

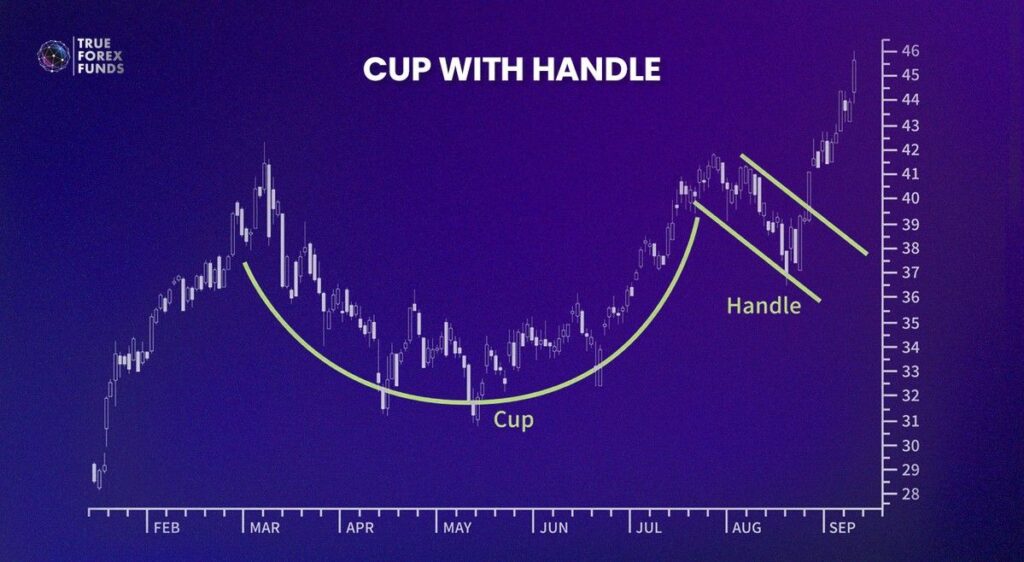

“The Cup” and “The Handle”

Now that you understand the impact the cup and handle pattern can have on your forex strategy, so how do we recognize it? Let’s break it down into two essential components – “The Cup” and “The Handle”:

- The Cup: Initially, the price of that asset takes a significant upward leap, perhaps by 30% or more. The cup and handle pattern emerges when the price takes a breather from its rapid ascent. Some traders may decide to capitalize on their profits during this pause, while others assess their next strategic moves.

- The Handle: Following the temporary pause in the exchange rate, there might be a slight dip, around 10% to 15% lower than before. This dip forms what’s known as a handle—a brief interlude before potential further developments in the currency pair’s value.

William O’Neil’s Insights for Traders:

William O’Neil suggests that the cup’s depth should ideally range between 12% and 33% from the highest point. However, in more volatile market conditions, certain currency pairs might experience more substantial drops, possibly in the range of 40% to 50%. O’Neil’s advice, tailored for those selecting individual assets for investment, still holds relevance for traders navigating the forex markets.

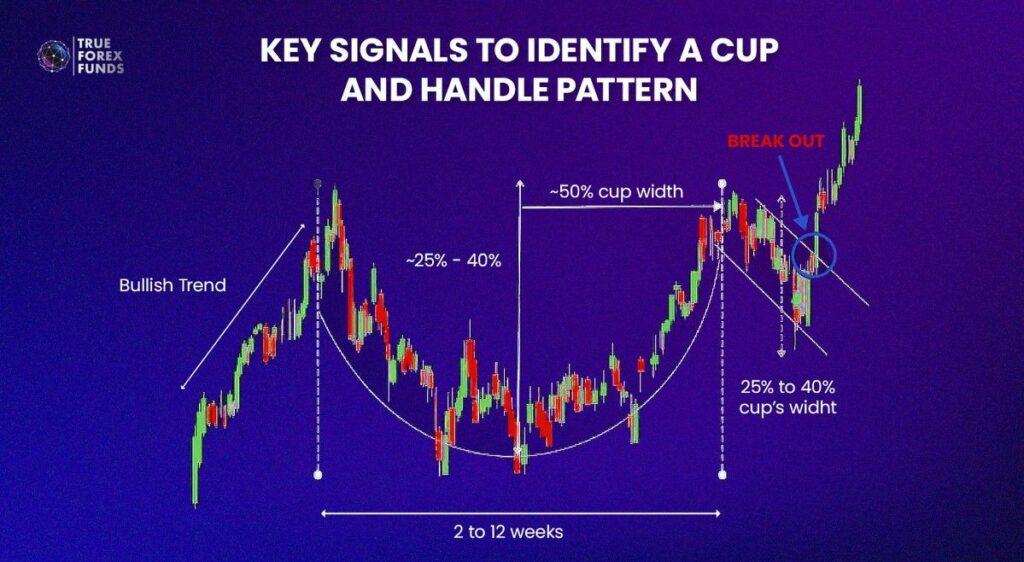

Key Signals to Identify A Cup and Handle Pattern

Let’s simplify the six vital signals to look for when a cup and handle pattern appears:

- Trend: Before the pattern forms, the trend should be bullish. Things are generally going up.

- Cup Shape: The cup formation needs to have a “U-shaped” structure rather than a “V-shaped” one. That distinctive ‘U’ is crucial for this pattern.

- Cup Depth: The cup should go back a bit, but not too much—somewhere between 25% and 50% of its depth.

- Handle: After the cup, there’s a little handle. Picture it like a flag during a brief pause. This handle part shouldn’t be too wide, usually around 25% to 40% of the cup’s width.

- Volume: Pay attention to volume dynamics. Volume should decrease during the initial half of the cup formation, increase during the right side rise of the cup, and show a similar behavior during the handle formation. A breakout above the rim level should be supported by a substantial surge in volume.

- Duration: For the pattern to be valid, it should have an extended breadth, lasting between 2 to 12 weeks.

How to Trade a Cup and Handle Pattern

Step 1: Protect Your Trade With a Stop-Loss:

Utilizing a stop-loss is a crucial element when trading the cup and handle pattern. This order serves as a safety net, automatically exiting the trade if the price drops instead of rallying after a breakout. Placing the stop-loss below the lowest point of the handle ensures risk control, selling the position if the price decline invalidates the pattern. It prevents potential losses and maintains trade discipline.

Step 2: Identifying Entry Points

Trading the cup and handle pattern is relatively straightforward, requiring patience for clear signals. Three key entry points include:

- Buying when the cup’s bottom is freshly formed. Monitor as the price consolidates, forming the cup’s bottom. Initiate a buy when the price starts curving upward, accompanied by increased volume compared to the previous phase.

- Alternatively, consider buying at the handle’s bottom. Typically, this is around ⅓ of the cup’s height, providing another strategic entry point.

- The final entry strategy involves buying when the price breaks out above the cup’s rim. Look for higher-than-average volume during the breakout session, signaling potential upward momentum.

Step 3: Price Target

Establishing a realistic price target is essential for optimizing gains. If entering early at the handle’s bottom, set a short-term target around the area where the resistance line crosses the cup’s rim. In the event of a breakout from the handle, the pattern is considered complete, prompting investors to consider selling stocks to secure profits.

Step 4: When to Cut Losses

Having clear principles and convictions is crucial for investors. Based on the cup and handle pattern, choose a point when the price breaks below the resistance line through the cup’s rim or when the loss reaches 5% to 7% of the purchase price. This disciplined approach ensures a prompt exit strategy, minimizing potential losses and adhering to a well-defined risk management strategy.

Limitations

However, the cup and handle pattern, while a useful tool in technical analysis, comes with certain limitations that traders should be mindful of:

- Time-Consuming Formation: The pattern typically takes weeks to months to form, testing the patience of traders seeking quick opportunities.

- Market Conditions Impact: The effectiveness of the pattern can be influenced by overall market conditions, with reliability decreasing in choppy or unpredictable markets.

- Volume Ambiguities: Volume analysis associated with the pattern can be ambiguous, making it challenging for traders to interpret.

- Subjectivity in Pattern Recognition: Recognizing the pattern involves a level of subjectivity, leading to variations in interpretation among traders.

Practicing to Gain Profit With Cup and Handle Pattern

Whether you’re an experienced trader or just getting started in the exciting world of financial markets, using the cup and handle pattern can boost your trading strategies along with other candlestick patterns. However, it’s essential for traders to be aware of the pattern’s limitations and learn from real-world experiences.

To gain practical skills, join True Forex Funds

By registering with True Forex Funds, you’ll have access to capital, reducing concerns about your initial investment. This way, you can focus on refining your trading skills and navigating the markets with more confidence.