The path to success in forex trading demands consistency, boundless patience, and a keen understanding of the complexities of the market. Traders can always count on True Forex Funds regarding educational topics.

Above all, the critical decision of selecting the right currency pairs to trade is the cornerstone upon which your forex empire will be built. This choice significantly influences your trading strategy and risk management, making it a vital aspect of your aspirations in trading.

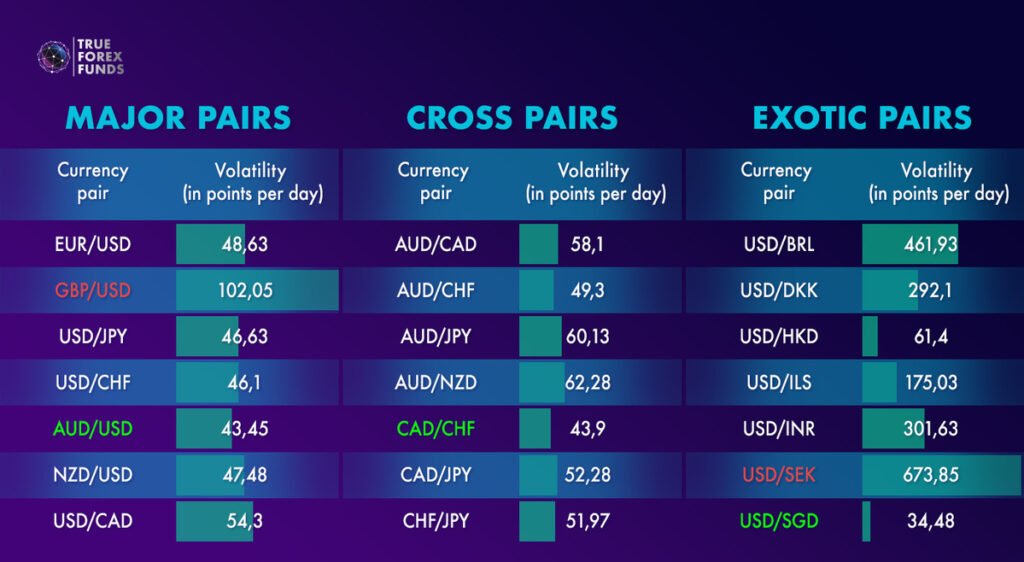

When it comes to choosing currency pairs, there is one superior factor: Volatility.

It simply indicates an instrument’s liability to change rapidly and unpredictably. Not all currency pairs are created equal in this regard. Some pairs stand out as the most volatile of the lot, and there’s a reason behind their prominence in the forex world.

The most volatile forex pairs have the potential to deliver profit or inflict substantial losses. Hence, choosing these pairs requires utmost caution. In this guide, we will jump into the concept of volatility and its origins. Furthermore, introduce you to some of the most volatile currency pairs available in the forex market.

Understanding Volatility in Forex Currency Pairs

Volatility is a term frequently bandied about in the world of forex trading, and for good reason. If you aspire to become a successful forex trader, understanding the essence of volatility is imperative. In simple terms, volatility refers to the frequency and magnitude of fluctuations in a currency pair’s value. It is commonly quantified by calculating the variance or standard deviation of price movements within the forex market.

This information serves as a guidance for traders and investors, helping them through the tricks and tips of market dynamics. It aids in predicting investment opportunities and forecasting movements of a currency. The most volatile forex pairs exhibit significant price swings over a given period, in contrast to their less volatile counterparts, which experience more modest price shifts.

It’s essential to note that volatility is inherently tied to both the base and quote currencies. Specific events can trigger significant fluctuations in a currency pair’s value. These events may encompass geopolitical developments, shifts in interest rates, and other market-moving factors. An illustrative example of high volatility can be observed in the EUR/AUD currency pair.

Factors Influencing Volatility in Trading

As previously mentioned, certain events serve as catalysts for volatility in currency pairs. Let’s take a look at them!

- Supply and Demand: The supply and demand dynamics of commodities such as metals, oil, and minerals can exert considerable influence on a forex pair’s volatility.

- Geopolitics: Political considerations wield significant power over the forex market. The imposition of tariffs on exports or imports, for instance, can contribute to heightened volatility.

- Market Information: Various market indicators, such as inflation rates, commodity availability, output figures, and unemployment rates, can sway the volatility of the most sensitive currency pairs.

Uncovering the Most Volatile Forex Currency Pairs

- AUD/JPY: This forex pair is renowned as the most volatile on our list. This pairing is highly sensitive to market changes. The Australian dollar’s wild fluctuations are influenced by its status as a commodity currency, linked to exports like metals, minerals, and agriculture products. In contrast, the Japanese yen is a safe-haven currency, sought by investors during economic uncertainties. These differences between AUD and JPY fuel dramatic price swings in the AUD/JPY pair due to global economic shifts.

- USD/MXN: This pairing observes/ compares the US dollar against the Mexican peso. Despite its liquidity, the USD/MXN pair remains highly volatile, primarily due to geopolitical tensions between the United States and Mexico. Additionally, the imposition of substantial tariffs on Mexican exports further amplifies its volatility.

- USD/BRL: The USD/BRL currency pair features the US dollar facing off against the Brazilian real. Day traders often relish the opportunities presented by this pair, as it exhibits frequent price movements that can translate into profits. The pair’s elevated volatility is rooted in Brazil’s political instability and a high corruption rate. These factors suggest that the USD/BRL pair is likely to remain volatile in the years ahead.

- GBP/AUD: The British pound versus the Australian dollar is a volatile cross pair that demands attention. The Australian dollar’s status as a commodity currency, coupled with trade tensions with China, has led to market turbulence, rendering this pair highly volatile.

- USD/ZAR: The US dollar against the South African rand, is among the forex market’s most dynamic pairs. Gold prices heavily influence this pair due to South Africa’s substantial gold exports. Fluctuations in the USD’s strength significantly affect the USD/ZAR pair, making it crucial for traders to monitor gold prices before trading this pair.

Additional Volatile Pairs to Consider:

- NZD/JPY: New Zealand dollar versus Japanese yen

- GBP/EUR: British pound versus Euro

- CAD/JPY: Canadian dollar versus Japanese yen

- USD/KRW: US dollar versus South Korean won

- USD/TRY: US dollar versus Turkish lira

Navigating Volatile Forex Pairs

For novice forex traders, the prospect of trading volatile currency pairs may seem daunting, as these pairs inherently carry higher risk. However, with a well-structured approach and a few strategic considerations, you can confidently navigate this terrain.

- In-Depth Understanding of Volatility: Begin by gaining a comprehensive understanding of volatility, including how to calculate it and the significant events that trigger it. Armed with this knowledge, you can make informed decisions when trading volatile pairs.

- Explore Various Trading Strategies: Implement a range of trading strategies that align with the ebb and flow of volatile markets. Strategies like scalping, day trading, swing trading, and price action can be effective tools in your arsenal when dealing with market turbulence.

- Distinguish High Volatility from Low Volatility: Recognize the distinctions between highly volatile and less volatile forex pairs. Highly volatile pairs tend to experience larger pip movements over time but are also more susceptible to slippage. Understanding these differences is vital to managing your risk effectively.

While volatile forex currency pairs may present greater challenges, they also offer the potential for substantial rewards. By honing your understanding of volatility, employing sound trading strategies, and discerning between high and low volatility pairs, you can embark on a profitable journey in the dynamic world of forex trading. Remember that, in the ever-changing landscape of the forex market, knowledge and preparation are your greatest allies.