Many of you who are interested in making money from Forex trading will often ask what is a prop firm and how is it different from a broker? It basically comes down to the way accounts are funded, along with different methods for calculating remuneration. A prop trading firm allows you to trade yourself, and with significant funding, while a brokerage (or broker), on the other hand, will execute the trades on your behalf, and will not offer additional funding to increase your starting capital.

Simply put: with a broker, you are limited by your own capital, but with a prop trading firm, like True Forex Funds, you have the opportunity to access significantly larger amounts of capital, potentially ranging from 100x to 1000x more compared to your initial capital, enabling traders to potentially trade with millions of dollars, depending on their scaling plans.

Never depend on small capital

Get fundedContents

- Introduction

- Leverage and Capital

- Trader Support and Education

- Risk Management and Trading Strategies

- Profit Sharing and Incentives

- Conclusion

- FAQ

Introduction

The term “stockbroker” still conjures the image of the Bowler-hatted city gentleman, with a briefcase and umbrella, going to the office. With the introduction of Forex prop trading, the idea of being a stockbroker seems slightly outdated. In fact, many of today’s most successful traders utilize opportunities offered by True Forex Funds and are trading from home.

When it comes to Forex trading, there’s no simple answer about whether it’s better to have a funded prop trading account or spend money with a broker. It all ultimately depends on your preferences and goals. However, there are many potential advantages to proprietary trading that make it more appealing. Let’s take a deeper dive to see the real benefits of funded prop firms over brokerages, and more importantly, why it’s the path you should follow.

Higher Leverage and Capital

Let’s begin with funding. In this respect, proprietary trading firms win hands down, as they offer significant trading funding. This capital is often referred to as “proprietary” or “prop” trading capital. Hence the name. It’s provided by the firm itself rather than by outside investors or clients. On the other hand, your own capital is at risk with a traditional trading firm.

With higher leverage and capital, traders are secured to have more flexibility in managing risk. One con with self-funded broker accounts is that traders with small capitals can often overleverage and run the risk of blowing their accounts, and even say goodbye to their funds. On the other hand, prop firms allow traders to trade with considerably greater amounts of capital to stay risk-managed, empowering longer-term success for themselves.

Higher Leverage

Because proprietary trading firms like True Forex Funds are providing their own capital for you, they can be more flexible in terms of the leverage they offer. This means that you’re able to take on larger positions with less of your own capital at risk. In contrast, more traditional stock brokers have to adhere to stricter regulatory requirements around leverage. In many cases, they are extremely limited in what they can offer their clients.

At True Forex Funds, we currently offer 3 account options, all with competitive leverages and the same trading conditions:

- Standard Account: This type of account maintains a conventional approach to trading, requiring a minimum of 5 trading days within 30 and 60 days for Phase 1 and Phase 2 of our evaluation process, respectively.

- Quick Funding Account: This account type accelerates your trading journey by eliminating the minimum trading day requirement, making it perfect for traders who prefer a quicker pace.

- Timeless Funding Account: This account provides an unlimited trading period, ideal for those who prefer a relaxed pace, free from time constraints.

See the True Forex Funds pricing for more details

Trader Support and Education

In addition to providing higher leverage, prop trading firms also offer you other valuable resources and support. With access to proprietary trading algorithms and strategies, as well as training, technical help, and development programs, you’ll improve both in your skills and with your performance. You’ll become more successful in the long run by staying on top of current market trends. These programs may include educational resources and opportunities to practice trading in simulated or live environments.

For a more hands-on learning approach, you can rely on a supportive community of traders who are happy to share insights and even offer mentoring. This can help with motivation, especially for those prop trading from home, whilst providing valuable opportunities for learning and growth. This can be especially helpful for those learning how to pass a prop firm challenge.

Join our Discord community and chat with other skilled traders

Finally, proprietary trading firms have systems in place to enable you to stay disciplined and focused. This can help recognize excessive risks, whilst simultaneously providing a framework for you to make sound trading decisions over the long term.

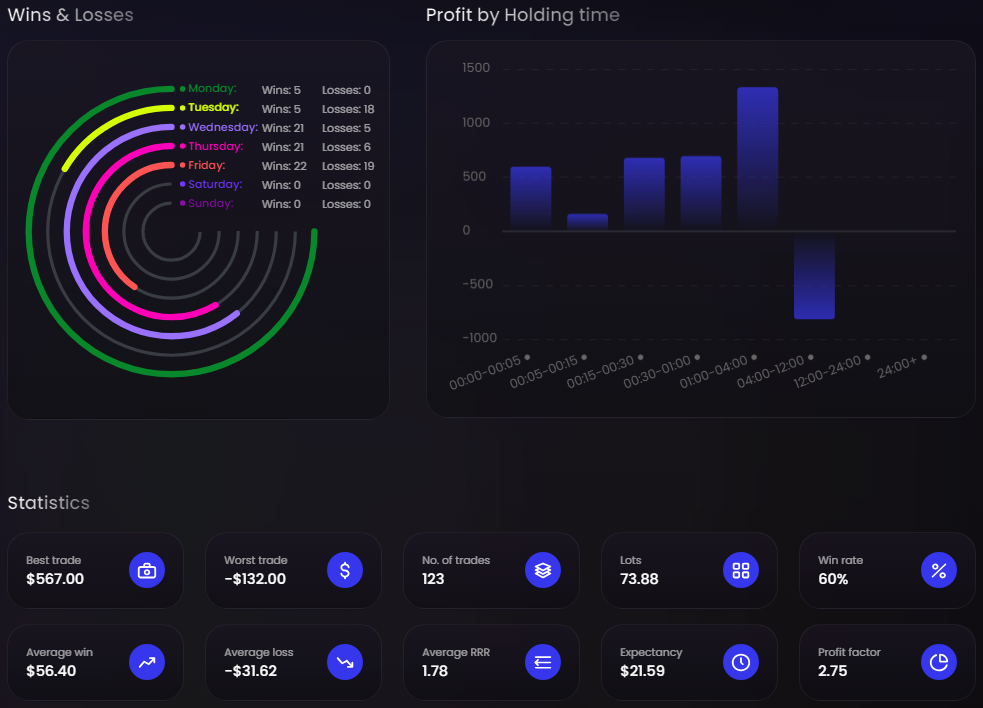

True Forex Funds is dedicated to supporting traders through their journey as they develop their skills. To show this dedication, we are transparent about all of our Payouts, and we also share some core statistics related to these payouts, so you can learn from successful traders.

As an appetizer, here are some screenshots from our Payouts stats page.

Learn more about our Payouts & Stats here:

Better Risk Management and Trading Strategies

As previously mentioned, Forex trading prop firms implement risk management policies to protect their capital by putting in place a range of controls and procedures to manage exposure. These policies are designed to limit the potential losses that can incur. They also ensure that the firm’s capital is not put at undue risk.

Position sizing

One of the key risk management policies used is “position sizing.” This involves limiting the size of positions you can take. This is achieved by either setting hard limits on the amount of capital you can deploy on a given trade, or by using sophisticated algorithms to manage real-time risk exposure.

Risk management

On the flip side, you’ll find a traditional broker firm may have to adhere to even more rigorous investment mandates or client preferences. This severely limits their ability to manage risk effectively. In addition, they’re often subject to more regulatory oversight and reporting requirements. Once again, this only adds to the complexity and costs of trading operations.

Another common risk management policy used by proprietary trading firms is “stop-loss orders.” Look at these as pre-defined exit points that you must stick to. They are designed to limit the potential losses on a given trade. If the price of an asset moves beyond a certain threshold, the stop-loss order will trigger and the position will be closed out, thus limiting any potential loss to the firm’s capital.

Hedging

It’s common for the best prop firms to use other risk management techniques, such as diversification and hedging. By spreading risk across a range of different assets, or by using hedging techniques to offset potential losses in one market with gains in another, prop trading firms can help to protect their capital and limit potential losses. As previously mentioned, proprietary trading firms maintain stringent risk management policies. These are overseen and enforced by experienced risk managers. Such policies may include limits on the overall level of risk exposure for the firm, as well as restrictions on the types of assets or markets that can be traded.

True Forex Funds listens to its traders and advocates no restrictions or constraints on position sizing or stop-losses, hence its traders can enjoy hedging on the same account.

To find out more about the authorized trading styles, follow this link

Generous Profit Sharing and Incentives

Looking at the more conventional Forex trading marketplace, you might ask what is a broker and what does a broker do for pay? Well, these brokers trade for clients and usually have profit-sharing arrangements that typically involve a percentage of the profits generated by each trade being paid to them as a bonus. When it comes to how much a broker makes, the exact percentage is often in the range of 20-50% split between themselves and their trading firm. Essentially, their fee is a percentage of the trader’s profits. Unfortunately, this is a wrong-headed incentive. It only encourages the trader to increase trading, regardless of whether the trades are profitable. Proprietary trading firms like True Forex Funds offer profit-sharing arrangements to help motivate you to perform better. Check our leaderboard to see some of the amazing profits generated through prop trading on their platform.

<h3>Incentive to trade successfully

It is worth highlighting that traders receive 80% of the profits from their funded accounts at True Forex Funds. This means that our traders only need to pay a nominal fee and in return, they gain access to a significantly larger trading account, unlike brokers where they only receive the exact amount they deposit.

To illustrate, consider this offer by True Forex Funds: a Standard account purchased for €998, will allow you to trade with $200,000, and you will reap the benefits and returns of this amount, too.

Even a modest 1% profit in the funded program can result in a substantial $1,600 profit for the trader, thanks to the 80% profit split. In comparison, on a traditional broker account, if a trader were to deposit €1000, a 1% profit would amount to a mere €10.

More importantly, by creating a generous financial incentive to generate profits for the firm, both your own interest, and that of the business, are aligned. Also profit-sharing arrangements in prop trading firms encourage you to take a long-term view of trading strategies and revenue.

Conclusion

Let’s recap the reasons why it’s better to get a funded account at a prop trading firm like True Forex Funds, rather than spending your own hard-earned money with brokerage firms:

- Capital: You’ll find that proprietary trading firms provide access to significantly more capital than a typical retail brokerage account. This enables you to take larger positions and earn higher profits. In contrast, retail brokers usually require traders to fund their accounts with their own capital. Obviously, this can be very limiting for traders who don’t have access to significant financial resources.

- Leverage: True Forex Funds provides you with significant leverage, which can further increase your potential profits. This is because they have the financial resources, whereas retail brokers may have only limited capital at hand.

- Education and training: Prop trading firms often provide you with education and training programs to help improve your trading skills. This can include access to more experienced traders, educational materials, and trading simulations. In contrast, retail brokerage firms often only provide limited educational resources. As you can imagine, this limits a trader’s ability to improve their skills.

- Risk management: The best Forex prop firms often have sophisticated risk management systems in place to help manage trading risks. This often includes risk limits, position sizing guidelines, and real-time monitoring of trading activities. These are particularly valuable for traders who don’t have either the experience or the resources to manage risk on their own.

- Incentives: As mentioned earlier, proprietary trading firms provide you with profit-sharing arrangements, which can provide strong incentives for you to perform well. This is because, at a company like True Forex Funds, you get to keep the lion’s share of the profits you generate. On the other hand, retail brokers typically earn their smaller fees regardless of whether their clients make money or not.

Overall, getting a funded account at a prop trading firm can provide you with access to more capital, leverage, education, risk management, and incentives than a typical retail brokerage account. This will help you improve your prop firm trading performance and potentially earn higher profits.

A good place to start your prop trading journey is by reading through the guides provided by True Forex Funds. These will give you a better understanding of all the strategies and principles needed to begin a successful career in prop firm Forex trading.

Ready to start your prop trading journey?

Get fundedFAQs

Simply put, you’re trading to make a profit. As opposed to retail brokerage firms, which are trading on behalf of clients and earning a commission.

Essentially, a prop firm provides traders with investment capital. In return, they receive a percentage of the profits. Your trading skills, their capital.

Everything comes down to working capital. As a prop trader, you’ll be using True Forex Funds’ capital, whereas a broker is using their own funds.

These days it’s a struggle to find reliable prop trading companies. You need to perform your own due diligence with care to ensure your company of choice is reputable. Check testimonials, and view the background of any managers to ensure they have a good track record.

Yes, you can. As you can see from the leaderboard, some traders make huge profits. But it’s important you understand how to mitigate risks. Having a rock-solid trading strategy, and sticking to self-imposed limits, along with putting in the research, is the only way to beat the market.

Your remuneration depends entirely on the performance of your sub-account. In other words, there’s no salary, simply your own profits or losses. What’s great about True Forex Funds is that the risk is asymmetrical, in that you get to keep 80% of all profits for yourself. However, you don’t have to bear any losses like a regular trader.

Traders can backtest their strategy for free on any platform and start with True Forex Funds’ entry-level account option, starting from only €89 with the benefits of accessing trading statistics in your client area, institutional raw spreads starting from 0.0 spreads and access to our support team.