When analyzing stock charts, candlestick patterns act like a roadmap for traders, giving them a clear picture of what’s happening in the market. Usually, one or two-candle patterns give crucial signals, while triple candlestick patterns provide more information about the market dynamics. Here are the 6 common types of triple candlestick patterns and their interpretations.

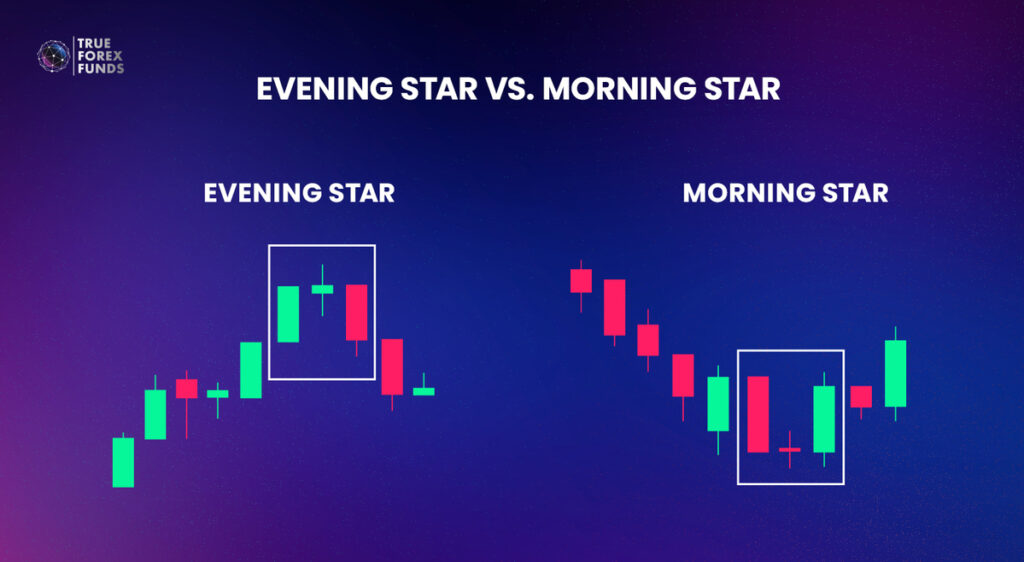

1. Evening and Morning Star

Features

The Evening Star and Morning Star are reversal patterns that signal potential changes in market direction.

| Evening Star | Morning Star |

| – Very often appears in a bullish trend. – The pattern kicks off with a large bullish candle, indicating a prevailing uptrend in the market. – Next comes a small bearish candle, deliberately not crossing the body of the initial strong bullish candle. This small candle reflects market indecision. The pattern wraps up with a substantial bearish candle. – Importantly, its body shouldn’t cross with the small second candle but must significantly penetrate the body of the first bullish candle (around 2/3 to 3/4 lower end). Suggests a potential shift towards a bearish reversal trend. | – Very often appears in a bearish trend. – The pattern kicks off with a large bearish candle, indicating a prevailing uptrend in the market. – Next comes a small bullish candle, deliberately not crossing the body of the initial strong bearish candle. This small candle reflects market indecision. The pattern wraps up with a substantial bullish candle. – Importantly, its body shouldn’t cross with the small second candle but must significantly penetrate the body of the first bullish candle (around 2/3 to 3/4 lower end). Suggests a potential shift towards a bullish reversal trend. |

Messages

In the initial phase, the buyer’s viewpoint is clear. The following smaller candlestick suggests uncertainty in the market. This is because the bulls, who usually drive prices up, are facing challenges, possibly due to a decrease in buyer interest or an uptick in seller activity. As the third candle develops, wiping out the gains from the preceding two periods indicates a situation where the buyers are giving up. This can be seen as a shift into buyer capitulation, marking a potential turning point in market sentiment.

The same principles apply to the Morning Star but are viewed from the opposite standpoint.

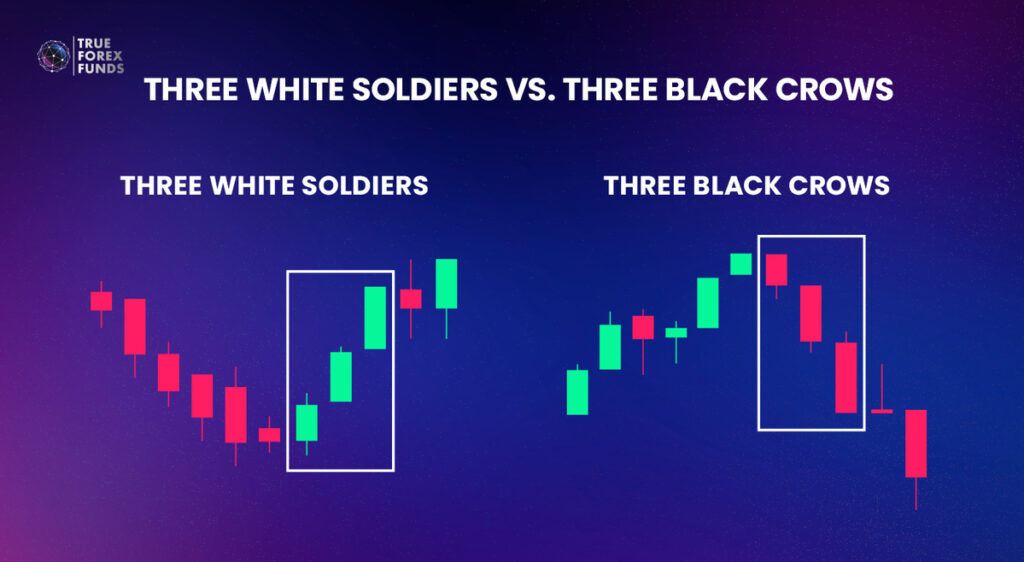

2. Three White Soldiers and Three Black Crows

Features

The Three White Soldiers and Three Black Crows are strong reversal triple candlestick patterns that indicate a potential change in trend.

| Three White Soldiers | Three Black Crows |

| – Appears in bearish trends. – Consists of three consecutive long bullish candles (White). – The First Soldier is a reversal candle, ending a downtrend or implying the end of a consolidation period. – The second candle must be larger than the previous candle, closing near its high without a significant upper wick. – The third candle should be at least the same size as the second, with a small or no shadow, confirming continued bullish momentum. | – Appears in bullish trends. – Comprises three consecutive long bearish candles (Crows). – The First Crow is a reversal candle that initiates the pattern, suggesting the potential end of an uptrend or a consolidation phase. – The second candle should be larger than the previous one, closing near its low without a substantial lower wick. – The third candle is often at least the same size as the second, featuring a small or no shadow. This confirms the sustained bearish momentum. |

Messages

When the Three White Soldiers candlestick pattern appears in a downtrend, it signals a strong upward reversal. The underlying idea is that when sellers are dominant, strong buying demand emerges, causing continuous price increases, indicating that buyers are taking the initiative. Conversely, the Three Black Crows candlestick pattern, often seen in an uptrend, signals a sharp reversal to the downside.

The pattern gains increased reliability when the body of the first candle is positioned above the low of the preceding black candle.

Furthermore, if the opening prices of the second and third candles align with the closing prices of the respective previous candles (first and second), this pattern is considered stronger and is referred to as “Identical Three Soldiers” or “Identical Three Crows.”

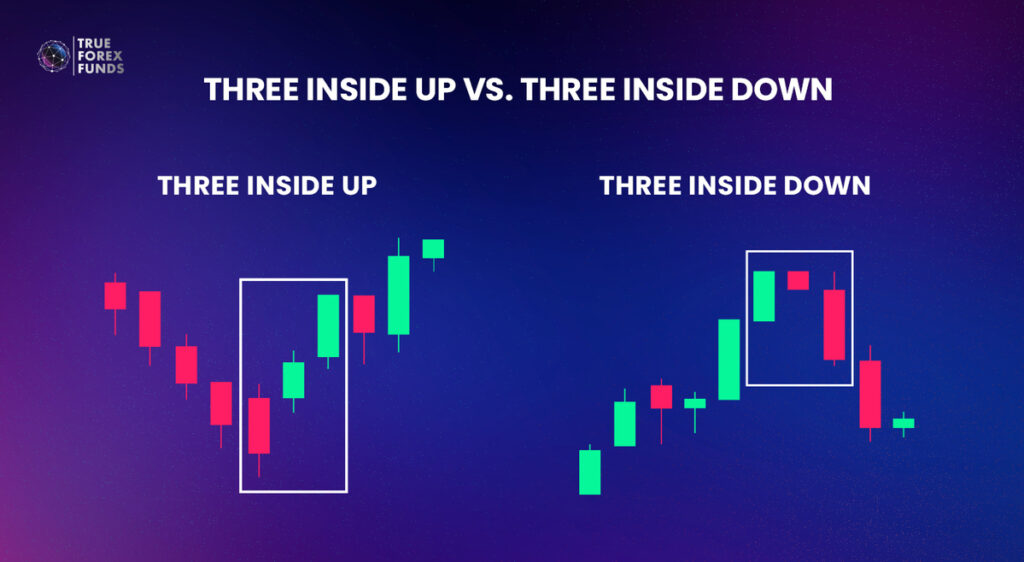

3. Three Inside Up and Down

Features

The Three Inside Up and Three Inside Down patterns are also reversal triple candlestick patterns.

| Three Inside Up | Three Inside Down |

| – Often found at the bottom of an uptrend. – The initial candle should be located at the peak of an uptrend and is marked by an extended bullish candlestick. – The second candle is bearish, often descending to at least the midpoint of the first candle. – The third candle is also bearish and must close below the low of the first candle. – Signalling the bearish reversal trend. | – Often found at the bottom of an uptrend. – The initial candle should be located at the peak of an uptrend and is marked by an extended bullish candlestick. – The second candle is bearish, often descending to at least the midpoint of the first candle. – The third candle is also bearish, and must close below the low of the first candle. – Signalling the bearish reversal trend. |

Messages

They mean that the current trend is possibly over and that a new reversal trend has started. The market dynamics of this pattern closely resemble those of the Evening or Morning Star. However, it appears more robust since the second candle lost more than half of the previous while by the third trading period, the reversal trend exerts full control over the market.

Decoding Triple Candlestick Patterns to Master Insights

Getting the hang of triple candlestick patterns can boost a trader’s confidence, offering valuable insights into market sentiment. Yet, it’s crucial to dive into the whole spectrum of candlestick pattern knowledge, starting from the basics and moving up to advanced concepts. This journey of understanding will not only enhance your trading skills but also pave the way for success in the world of forex trading.

Getting Start Your Learning Journey with True Forex Funds!

Embark on a secure and trustworthy learning journey with True Forex Funds! Unlock balanced options of up to $400,000, starting at just €89. Our commitment ensures a reliable opportunity for you to explore and learn, minimizing costs while gaining valuable insights into crucial trading patterns.