Have you felt the frustration of continuous learning without a clear roadmap for success? Navigating the trading world is like finding your way through a maze, and not every strategy is a winner. Over time, many have crashed and burned. However, in this jungle of methods, one survivor stands tall: Wyckoff Theory. Join us in this blog as we unravel the fundamental concepts of Wyckoff’s theory to decipher charts and understand the current phase of the market.

Who is Wyckoff?

Richard Demille Wyckoff, born in 1873, was a renowned stock market authority and one of five pioneers in technical analysis in the early 20th century. In his 20s, Wyckoff immersed himself in the finance industry while already becoming the head of his firm. By his 30s, Wyckoff co-founded The Magazine of Wall Street, where he dedicated himself to educating the public on smart money concepts and trading rules. Notably, he emphasized the importance of risk management and mastering stop-loss. His extensive experience in the financial industry led him to develop the Wyckoff Method – a comprehensive approach to trading and investing.

What is Wyckoff’s Theory?

Wyckoff’s Theory isn’t a mere speculation on market dynamics; it’s akin to a roadmap leading to substantial gains guarded by the moves of Smart Money. This method unveils the secret footprints of the big players, providing you with exclusive insights into their moves. Wyckoff’s Theory allows you to align your trading strategy with the most influential forces in the market. It’s not just a theory but your ticket to navigating the markets alongside the heavyweights who hold the key to significant financial rewards.

“The Composite Man”

Wyckoff’s theory revolves around the central idea of comprehending “The Composite Man,” a concept he presented as a singular entity orchestrating market fluctuations. In his book, he articulated this notion, stating, “all the fluctuations in the market and in all the various stocks should be studied as if they were the result of one man’s operations.”

The underlying principle is straightforward: if traders fail to understand how this ‘man’ operates, he may influence stocks to their disadvantage. Conversely, by grasping the tactics employed, traders have the potential to profit.

3 Basic Laws of Wyckoff’s Theory

Law of Supply and Demand

Wyckoff’s Theory starts with a simple idea – the Law of Supply and Demand. Imagine it like a seesaw between people who want to buy (demand) and those who want to sell (supply). This seesaw is what makes prices go up or down. By understanding if more people are buying or selling, traders can predict where prices might go.

In Wyckoff’s world, understanding the ebb and flow of supply and demand is akin to deciphering the market’s language. By identifying periods of accumulation (smart money buying) and distribution (smart money selling), traders gain a strategic advantage in predicting future price movements.

Law of Effort and Result

The Law of Effort and Result is about looking at how much people are trading (effort) compared to what happens to prices (results). If a lot of trading activity doesn’t lead to much price change, it could mean a possible shift in market sentiment.

On the other hand, strong price movements with a lot of trading suggest a more reliable trend. Traders using Wyckoff’s Method keep a close eye on how effort and results work together to make smart decisions about market trends.

Law of Cause and Effect

The Law of Cause and Effect is a cornerstone of Wyckoff’s philosophy. It says that every move in the market creates a reason that leads to a result. Traders using Wyckoff’s Method try to understand this cause-and-effect relationship to guess where prices might go next.

In practical terms, this means recognizing that significant events or actions in the market, whether accumulation or distribution, create a foundation for subsequent price movements. By understanding these underlying causes, traders can position themselves strategically to ride the effects in the market.

Wyckoff’s Rules

Wyckoff, after immersing himself in the complexities of the financial market, formulated two game-changing rules for traders seeking success.

Rule 1: The forex market and individual currency pairs are no fans of repetition. Rather than echoing identical patterns, trends showcase a kaleidoscope of variations, always introducing subtle differences. It’s akin to a shape-shifting dance, keeping a step ahead of those eager to capitalize on market movements.

Rule 2: To gauge the significance of a price movement, Wyckoff urges forex traders to explore its historical context. Context is the king of financial understanding. Evaluating today’s prices requires a journey through time – what transpired from yesterday to last year.

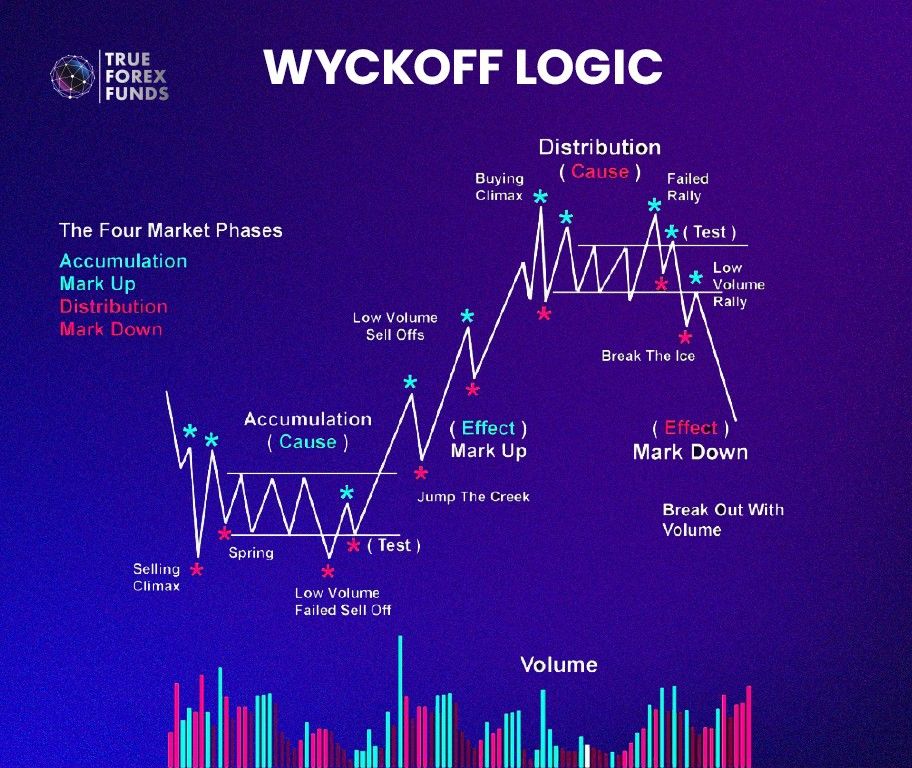

Wyckoff Market Cycle

Drawing on his extensive analysis of Supply and Demand dynamics, Wyckoff formulated the Wyckoff Market Cycle Theory. This theory simplifies this journey into four key stages, offering a practical understanding of how markets evolve.

1. Accumulation Phase

What happens: At the beginning of our market journey, there’s a quiet gathering of potential. Big players, often referred to as Smart Money, strategically accumulate assets at favorable prices. Prices move in a balanced manner.

What to do: Savvy investors recognize this as a prime entry point, anticipating an upward movement in prices.

2. Markup Phase

What happens: The market kicks into an upward swing. Prices surge, reflecting widespread optimism. Smart Money takes advantage of this by selling their holdings for a profit.

What to do: Investors ride the upward momentum, seeking to capitalize on the bullish trend.

3. Distribution Phase

What happens: As prices reach lofty levels, Smart Money starts selling their accumulated assets. The market becomes uncertain, moving in a range-bound fashion.

What to do: Informed investors may consider selling or preparing for a potential downtrend.

4. Markdown Phase

What happens: The final leg of our journey sees a pronounced downtrend. Smart Money strategically sells more, leading to a decline in prices.

What to do: Astute investors look for opportunities to buy at lower prices, anticipating a future upward movement.

5 Steps of How Wyckoff’s Theory Works

When choosing an entry point or a trading instrument, R. Wyckoff’s method can be condensed into a five-step strategy:

1. Assessing Market State and Projecting Trend

– Objective: Gain insight into the current state of the market and forecast its potential future trend.

– Action: Conduct a thorough analysis of market conditions, examining key indicators and patterns to anticipate the direction in which the market is likely to move.

2. Selecting Instruments Aligned with Trend

– Objective: Choose trading instruments that harmonize with the identified trend.

– Action: Pick assets or instruments that exhibit a correlation with the projected market trend, ensuring alignment with the overall market dynamics.

3. Evaluating Instrument Causes and Objectives

Objective: Opt for instruments with a “cause” that meets or exceeds the minimum trading objective.

Action: Scrutinize the underlying factors or catalysts driving the movement of selected instruments, verifying that they align with your predetermined trading goals.

4. Checking Readiness of Selected Instruments

Objective: Assess the readiness of chosen instruments for a substantial market move.

Action: Examine various indicators and market conditions to gauge the preparedness of selected instruments, ensuring they are poised for significant price action.

5. Strategically Timing with Market Index Turn:

Objective: Time your trading commitment to coincide with a turn in the overall market index.

Action: Monitor the broader market index for key signals indicating a shift in market sentiment or direction, and strategically execute your trading moves accordingly.

Conclusion

Wyckoff’s Theory is a reliable guide for traders dealing with market volatility. This time-tested approach offers a systematic methodology and adaptability across diverse markets. Whether you’re new or experienced, Wyckoff’s Theory gives you a straightforward and trustworthy way to make decisions.

Unlock the power of Wyckoff’s Theory and level up your trading skills!

Register with our prop firm today for a hands-on opportunity to practice and apply Wyckoff’s insights in a real trading environment.