Understanding forex lot sizes is crucial for beginner traders as they determine the volume of a trade and play a significant role in position sizing and risk management. In this article, we will delve into the world of lots, exploring their types, calculation methods, the use of lot size calculators, the capital required for trading one lot, and more.

What are lots in forex trading?

In forex trading, a lot refers to the standardized volume of a trade: 100,000 units of the base currency. This is a basic notion in forex trading as it helps traders across the world to size their positions based on a globally accepted standard.

The standard lot size

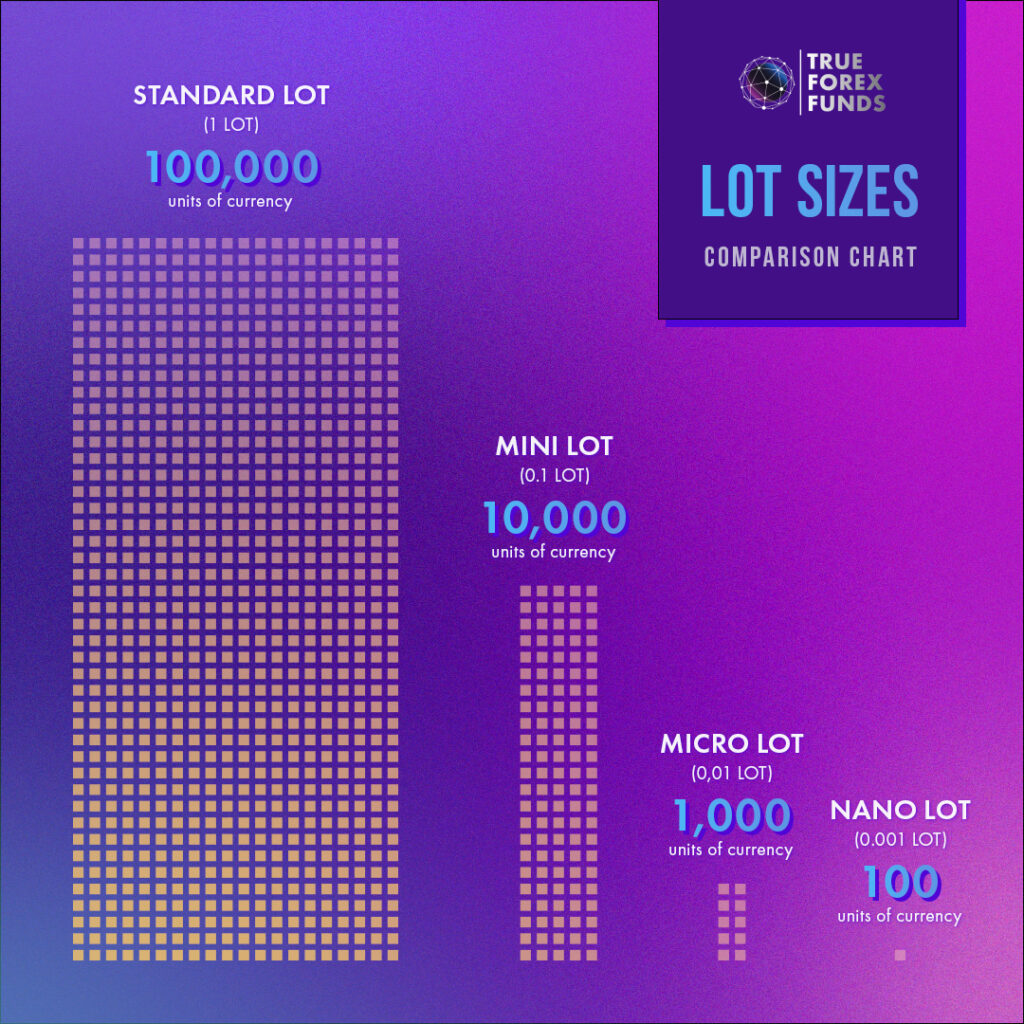

Standard lot size means 100,000 units of the base currency. For example, if a trader buys one standard lot of the EUR/USD pair, they are buying 100,000 euros. However, not all traders can afford to trade with such large amounts. Therefore, there are other lot sizes available:

- mini lots (10,000 base currency units)

- micro lots (1,000 base currency units)

- Learn more about micro lots in our blog post: The Art of Trading Micro Lots

- nano lots (100 base currency units)

Different lot sizes allow traders to control their position sizes according to their account balance and risk tolerance. By choosing an appropriate lot size, traders can maintain a balanced risk-reward ratio.

Start trading with True Forex Funds

Get fundedCalculating lot sizes in forex trading

Lot sizes determine the value of each pip movement in a currency pair.

- In a standard lot size trade, each pip movement is worth $10 (for currency pairs with the US dollar as the quote currency).

- In a mini lot size trade, each pip movement is worth $1

- In a micro lot size trade, each pip movement is worth $0.10.

Trading a standard lot means that each pip movement will have a larger impact on your account balance than trading a mini or micro lot size. As such, you should carefully consider your risk tolerance and account size before deciding on a lot size.

The formula for calculating lot sizes incorporates three main factors:

- Account size

- Risk percentage

- Stop loss level

To determine the appropriate lot size, follow these steps:

- Determine your account size – the total amount of capital you have available for trading.

- Set your desired risk percentage – the percentage of your account balance you are willing to risk on a single trade. It is generally recommended to risk no more than 1-2% of your account balance in any given trade.

- Define your stop loss level – the price level at which you would exit the trade if it goes against your anticipated direction. The stop loss is usually measured in pips.

Once you have these values, you can use the following formula to calculate the lot size:

Lot size = (Account Size * Risk Percentage) / (Stop Loss in Pips * Pip Value)

Here’s an example to illustrate the above. Let’s say you have an account size of $10,000, you are willing to risk 1% of this money on a trade, and your stop loss is set at 50 pips with a pip value of $10. The calculation would be as follows:

Lot size = ($10,000 * 0.01) / (50 * $10) = 0.2

This means you would be trading 0.2 standard lots or 20 mini lots, if mini lots are available on your trading platform.

Using forex lot size calculators

Forex lot size calculators are valuable tools that simplify the process of determining lot sizes. These are online calculators that automate the calculation using the same factors as above: your account balance, risk percentage, and stop loss level. By using a reliable and accurate forex lot size calculator can save time and ensure precise position sizing.

Ready to start your trading journey?

Get fundedHow much money do I need to trade 1 lot?

To determine how much money you need to trade one lot in forex, you will need to understand the concepts of margin requirement and leverage.

- Leverage is the practice of borrowing money from your broker to amplify your buying power by allowing you to control a larger position size using the borrowed funds.

- Margin refers to the collateral you need to put up to open a trading position.

There are two key factors that influence how much capital is needed to trade 1 lot in forex.

- The currency pair you trade will affect the margin requirements. Each currency pair has its own volatility and price movements, which can impact the amount of capital needed to trade 1 lot.

- The other important factor is the leverage ratio, which determines the amount of borrowed funds you can utilize for trading. Higher leverage ratios require less capital to trade 1 lot but also increase risk.

Start trading today!

Get fundedHere are a couple of examples of how this works in real life.

Let’s assume you want to trade one lot of EUR/USD with a leverage of 50:1 leverage. If the margin requirement is 2%, you will need to allocate 2% of the notional value of the trade as margin. The notional value of one standard lot of EUR/USD is 100,000 euros, which is equivalent to $110,000 at an exchange rate of 1.1. Therefore, the margin requirement for one standard lot of EUR/USD with 50:1 leverage is $2,200 (2% of $110,000).

Lot sizes and leverage at True Forex Funds

True Forex Funds offers a 1:100 leverage. With the smallest account size of $10,000 a 1:100 leverage enables you to open a 100 times bigger position of $1,000,000. This means that you can have access for a 10-lot trade position ($1,000,000) for just a €89 refundable fee.

Margin requirements are not capital requirements

Remember that margin requirements do not equal capital requirements for your trading account. You need to have enough capital to cover potential losses from the trade. In forex trading, the potential loss is the difference between the entry price and the stop loss price, multiplied by the lot size and the value of one pip.

Let’s say you want to buy one standard lot of EUR/USD at an exchange rate of 1.1 and a stop loss at 1.09, which is 100 pips below the entry price. The potential loss for this trade is $1,000 (100 pips x $10 per pip x 1 lot). As a result, you will need to have at least $3,200 in your trading account to trade one standard lot of EUR/USD with 50:1 leverage ($2,200 for margin + $1,000 for potential loss).

Risk management and lot sizes

Risk management is a vital aspect of successful forex trading. The forex market is inherently volatile and without proper risk management, traders expose themselves to significant financial losses. Risk management involves implementing strategies and techniques to control and minimize potential risks. Think of it as a set of rules that protects your trading capital, preserves long-term profitability, and maintains emotional stability during trading.

The importance of lot sizes in risk management

Lot sizes play a crucial role in managing risk as they determine the potential profit or loss per trade. Smaller lot sizes, such as micro lots or mini lots, allow traders to allocate a smaller portion of their capital to each trade. This helps in diversifying the risk across multiple trades, reducing the impact of any single trade on their account balance. Conversely, larger lot sizes increase the potential profit or loss of a trade, but they also increase the risk and exposure to the market.

If you are new to forex trading, start with smaller lot sizes. As you gain more experience and confidence, gradually increase your lot sizes. This allows you to scale your risk exposure in proportion to your growing trading capital, while still maintaining proper risk management practices.

Bottom line

A lot refers to the number of currency units in a trade. The standard lot in forex trading involves 100,000 units of currency. In addition to the standard lot, there are other lot sizes available, including mini lots (10,000 units), micro lots (1,000 units) and nano lots (100 units).

The different lot sizes provide traders with the option of controlling the size of their positions based on their account balance and risk tolerance. Selecting the right lot size can greatly help traders to maintain a balanced risk-reward ratio.

Understanding lot sizes is fundamental for beginner traders venturing into the world of forex. By grasping the significance of lot sizes and incorporating them into their risk management strategy, will help them gain more confidence and maximize their trading potential.

Put your newly acquired knowledge about lot sizes to the test and become a funded trader with True Forex Funds. Sign up for an evaluation and get access to a well-funded account and state of the art trading conditions.

Start trading with True Forex Funds today

Get fundedFAQs About Lots and Lot Sizes

In forex trading, a lot is a standardized unit of measurement used to quantify the volume of a trade. It represents the number of currency units that are bought or sold in a single transaction. The concept of lot sizes allows traders to control the position size and determine the potential profit or loss of a trade.

There are three main types of lot sizes in forex trading:

1.) Standard lot – it is the largest lot size and represents 100,000 units of the base currency. For example, if the base currency is the U.S. dollar (USD), one standard lot of EUR/USD would be equivalent to 100,000 euros.

2.) Mini lot – it is one-tenth the size of a standard lot and represents 10,000 units of the base currency. Using the same example, one mini lot of EUR/USD would be equivalent to 10,000 euros.

3.) Micro lot – it is one-tenth the size of a mini lot and represents 1,000 units of the base currency. Continuing with the example, one micro lot of EUR/USD would be equivalent to 1,000 euros.

Some brokers use nano lots as well, which contain 100 currency units.

It is not difficult to calculate the exact amount of currency involved in a certain lot size. If you trade one standard lot of EUR/USD at an exchange rate of 1.2000, a standard lot means it costs 120,000 units of the quote currency (USD) to buy 100,000 units of the base currency (EUR). The same applies to mini and micro lots. If you trade a mini lot of EUR/USD at an exchange rate of 1.2000, you will need 12,000 units of USD to buy 10,000 units of EUR.

How much money you need to trade 1 lot depends on the currency pair, the leverage ratio and the margin requirement.

If you trade one lot of EUR/USD with a leverage of 50:1 and a margin requirement of 2%, you will need to have 2% of the notional value of the trade as margin in your account. The notional value of one standard lot of EUR/USD is $110,000 at an exchange rate of 1.1. Therefore, the margin requirement for one standard lot of EUR/USD with 50:1 leverage is $2,200 (2% of $110,000). In addition, your broker will require you to have enough funds in your account to cover the potential loss of your trade. The potential loss is the difference between your entry price and the stop loss level, multiplied by the lot size and the value of one pip.

In forex trading, micro lots represent 1,000 units of the base currency. If you trade a micro lot, your capital requirement will be lower than trading a larger lot size and you will be able to limit your potential losses. Opening more trades with micro lots will yield a better risk-reward ratio than opening one large position. Micro lots allow beginners to gain more experience without risking large amounts of capital. A smaller lot size means you can adjust your position size more precisely to your risk tolerance.

A trade’s lot size directly affects the amount of money that is at risk. If you trade with an appropriate lot size, you can protect your account from significant losses. The smaller the lot size, the more control you have over risk.

Lot sizes will also determine the size of your position thus affecting your potential profit or loss on a trade. Learning position sizing is key to any successful forex trading strategy. Using different lot sizes in your trades allows you to scale up or down your trading activity and maintain your risk exposure.