What is rollover?

A rollover in CFD trading is the act of maintaining an open position beyond its expiry date.

CFDs allow investors to trade the directions of the markets and profit from changes in the exchange rates. It provides all benefits without actually owning the products or having to take physical delivery of the asset. For these reasons, a standard swap trading cost is applied when holding positions overnight.

Rollover refers to the process of delaying the settlement date of an open position in the Forex market. A trader must typically receive delivery of the currency two days following the transaction date in most currency exchanges.

However, when a position rolls over, the settlement is postponed until the following day, at which point long-term forex traders who hold positions overnight may receive or pay swaps accordingly to the forex pair’s interest rate differentials.

Affects of Market Rollover

It’s critical to understand the Market Rollover period and how it may affect your trading.

On our server, the rollover occurs at 22:00 GMT+0.

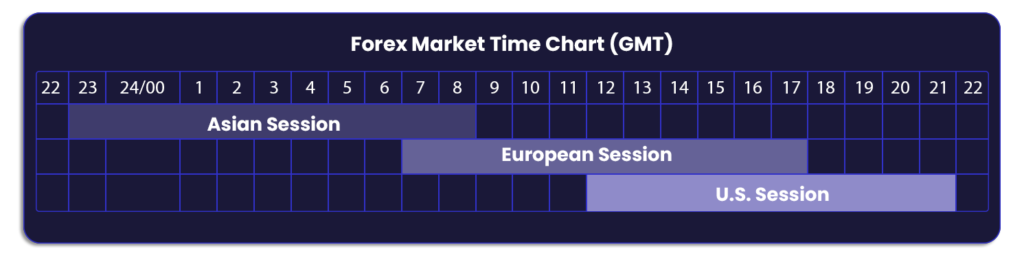

Peak activity periods are the major trading sessions. The U.S. session closes at 22:00 (GMT+0), while the Asian session opens at 23:00 (GMT+0). During the downtime, the interbank market is less liquid as investors halt pricing for routine business operations. As the banks rejoin the trading session, the liquidity in the underlying market is significantly lower.

In consequence, spreads across markets can notably widen compared to times of the trading day when there is greater liquidity. Spread widenings may extend indefinitely before and after rollover time.

Widening spreads aren’t the only thing traders should anticipate encountering; they should also prepare for turbulent market movements and price gaps that are unusually present. Although some may view this as an opportunity, the trading day’s fundamental riskiest phase comes at this time, and open positions may suffer as a result of the higher volatility.

The rollover is not anything exclusive to True Forex Funds, but a general market phenomenon and a fact of trading in the interbank market.

Executing during rollover

Executing a trade during a rollover period could be trickier than you think. The market may gap during these times, spreads may widen and fewer countertrades would be accessible, which could result in unforeseen events.

Why? The underlying market’s lack of liquidity, which results in few participants pricing at this time, is the cause of this. As a result, the requested price might no longer be available, which can lead to adverse fills.

Conclusion

Accordingly, traders should keep this in mind when maintaining open positions and taking on new ones during the market open and roll-over periods or when liquidity is low by being mindful of this, taking precautions to reduce the possibility of unfavorable fills during market rollovers volatility and at times when liquidity is lacking.