There is going to be a lot of price volatility in the forex and commodity markets in 2023 as a result of political and economic events that will shake the world. These will produce great opportunities to profit from the news. This article will show you which macro economic data you should be trading in 2023. The TFF Funded Trader program will give you the funding you need to trade these news.

What is economic news?

Economic news describes the key data, statistics, information, or updates about the state of various sectors of a nation’s economy. In the financial market, the economic news is the term used to describe macroeconomic and microeconomic data detailing the state of a country’s economy.

What is macroeconomic data and why are they important?

Macroeconomic data are statistics that detail the performance of various sectors that make up a nation’s economy and provide a general overview of that country’s economy. The word “macro” means “large” and indicates that these data give a broad view of an economy rather than a microscopic view (microeconomic data) of individual sectors.

Macroeconomic data are collected, collated, and reported by governmental and private institutions. Investors, policymakers and businesses use such data to make projections, identify trends and opportunities, and provide forward guidance on their businesses.

Macroeconomic data will encompass information and updates on critical economic indices such as inflation, interest rates, data on manufacturing conditions (e.g., PMI data), unemployment rates, trade balances, etc.

For instance, inflation data from the consumer and producer ends of the supply chain provide information about a nation’s inflationary trends. These inflation data are:

- the Consumer Price Index (CPI), and

- the producer price index (PPI).

The problem with high inflation

High inflation is a sign of too much money chasing too few goods, ultimately leading to a country’s cost of goods and services skyrocketing and reduced purchasing power of the country’s currency. If allowed to go too high, it will lead to a situation where people cannot afford the cost of essential items such as food, housing, fuel, etc.

Unchecked inflation could lead to social unrest could, which is an undesirable effect from the standpoint of social and economic stability. No investor will bring their money into a politically and economically unstable country. So the monetary authorities in the country will do what they can to check any inflationary excesses, usually by controlling the money supply.

How inflation affects economic growth

On the other hand, if inflation drops too low or we have a situation of stagflation or deflation, wages will fall, economic growth will slow, and unemployment will occur. These factors are also capable of producing economic and social unrest. So knowing the state of inflation helps monetary authorities know when to deploy specific tools to keep it at a certain acceptable level.

The imporatance of news in forex trading

Since we are talking about the forex market and are participants in the TFF evaluations leading to becoming funded traders, our approach to the economic news data would be from the investors’ standpoint. Economic news will determine whether a nation’s currency will see demand or will be offered in exchange for another with better prospects. This is why the news moves the financial markets.

The news primarily dictates the price movements of the financial markets. Some of this news can have such an impact on market instruments as to produce an effect that will last for days. Therefore, anyone participating in the evaluation programs on TFF must prepare to trade the news to achieve the set targets.

What economic news should you be trading?

Most market-moving news is listed in a monthly schedule known as the Economic News calendar. This calendar can be found online as a free resource on various websites and the MT5 platform. All news events do not carry the same impact. There are low-impact, moderate-impact or high-impact news. Low-impact news is lightly regarded and only carries a little weight to generate the kind of volatility that traders can aim to profit from. On the other hand, the high-impact news are macroeconomic data sets that cause heavy market volatility because of the importance they bring to bear on institutional traders’ perspective on a nation’s economy.

The degree of the market impact of a news release is subject to the prevailing economic conditions. What may be of low impact at a particular time can become a high-impact news release if there is a dynamic shift in the global economy. For instance, as of 2023, the impact of inflation numbers on the forex markets is much more significant than what these numbers used to be in years gone by. This is because the market dynamics currently consist of rising prices that have resulted from having so much money from pandemic stimulus programs chasing fewer goods emanating from a recovering supply chain. In the aftermath of the global financial crisis of 2008, caused by the collapse of the subprime mortgage market, housing data became the largest mover of the financial markets. As of 2023, housing data are not considered high-impact news items. So you need to be aware of the market dynamics and understand the relevant economic news for the moment.

Another point you must be aware of is that some high-impact news releases may be unique to some countries. For instance, the Empire State Manufacturing Index is native to the US and is currently considered a high-impact news release. The voting patterns of the members of the Bank of England’s Monetary Policy Committee (MPC) is also considered a high-impact news item when used as a pointer to the direction of future interest rate decisions. This is the only central bank where this metric appears on the economic news calendar.

As of the time of writing this blog post in 2023, the high-impact economic news data of importance are:

- Inflation data (Consumer Price Index, Producer Price Index, Core PCE Price Index, in order of decreasing importance).

- Interest rate expectations and decisions.

- Speeches, comments and interviews by central bank chiefs or governing board members.

- Minutes of the Federal Open Market Committee (FOMC) meetings of the Federal Reserve.

- Post-rate decision statements from central banks (usually read out by the Governors or Chairmen).

- Employment data (Non-Farm Payrolls, ADP Employment Change, Unemployment rate).

- Manufacturing data (especially from China) includes various PMI data from various sources.

- Retail sales (headline and core).

- Gross Domestic Product (GDP).

True Forex Funds allows participants in the evaluation programs to trade the news. The MT5 platform contains an economic calendar for users. This is how it looks:

Elements of a news trade

Every news trade has parameters that are used to measure how positive or negative the news is. For this, you need data to show what the previous readings have been (for comparison), and you also need to have expectations that economists have developed. You should also see if the actual release meets the expectations and check how close or far off all the numbers are from each other.

Most of the economic news you see on the calendar have the following elements:

- Consensus figure

- Actual number (i.e. the data released as the news)

- Previous number

- Potential Revisions

The basis of the news trade is to see if the actual number matches the market consensus. If the actual figure is better than expected, this is good for the currency. If the actual number is lower than expected, this is usually bad for the currency in view.

If the numbers are different, you will look for a deviation. A deviation between the actual and consensus usually provides the basis for the news trade. The wider the deviation, the greater the market volatility that follows.

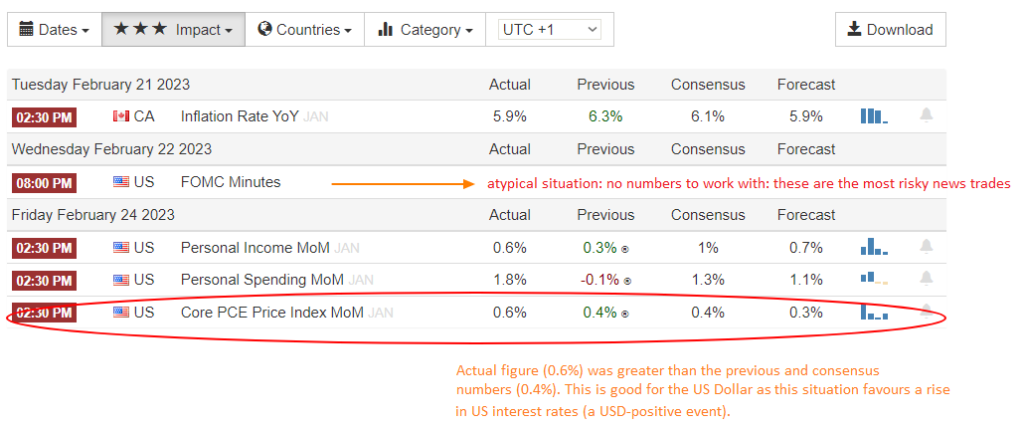

The snapshot above is taken from the economic news calendar of Trading Economics. This is a good source for your economic news calendar, because it allows you to customize the settings to show just the high-impact news. It also shows you all the numbers at a glance, and you can select just the countries whose economic data you want to be traded. In this snapshot, only high-impact news emanating from the United States has been selected, making USD pairs the currency pairs of choice to trade here.

We can see that under the FOMC Minutes, there are no numbers to trade with. This makes it difficult to get profitable trades because you are basically relying on the perception of the institutional traders on the tone of the document’s contents. This can be quite subjective and makes this trade event risky.

On the other hand, the news event circled in red (Core PCE Price Index (MoM)) has the previous and consensus numbers clearly shown. This makes the trade outcome more objectively based and easier to predict the price direction based on the news. For this news release, here was the outcome:

- Previous: 0.4%

- Consensus: 0.4%

- Deviation expected = consensus – previous number = 0.0%

This means that polled economists were expecting no change in this inflation barometer.

The actual news came out and showed a rise in this metric by 0.6%. This was not only higher than expected, but it also produced a tradable deviation.

- Tradable deviation = actual number – consensus number (0.6% -0.4%) = 0.2%

- This upside deviation is traded in favour of the US Dollar, as the increase in this metric is a future predictor that the Fed will raise interest rates to curb inflation.

To trade, this, you would have to go long on USD pairs where the US Dollar is the base currency, or go short on pairs where the US Dollar is the counter currency. However, there is a technique to setting up the positions, which is discussed under the typical price action of a news trade paragraph below.

Atypical Scenarios

The situation described above is the ideal scenario for a news trade. Typically, a good news trade setup is one in which the actual is better than the consensus/better than expected (buy) or worse than the consensus/lower than expected (sell), with a wide deviation. However, there are times when this rule does not apply. When this occurs, the trader must check to see if these atypical scenarios apply.

- When a number has already been priced in

If the actual news number has already been priced into the asset’s recent price action, you will get a muted response because the market’s expectations have been met. In extreme cases, you may even get a reverse response as institutional traders start to unwind positions they assumed when the pricing-in process started.

- The market focuses on trends and not on a single actual number

There are times when the actual number may not be greater or lesser than the consensus number by much, thus producing a smaller-than-expected deviation. Sometimes this deviation may not be the focus of the market. Instead, the market may look at the trend of previous numbers. Are they showing a consistent rise or drop, despite the actual number not producing a tradable deviation?

- Actual number not meeting expectations, but better/worse than the previous number

There will be periods when the actual number does not match or exceed the market expectations (consensus number) and yet be better than the previous number (BUY) or worse than the previous number (SELL). On such occasions, traders may decide to trade based on whether the actual number was better or worse than the previous number. This usually produces little volatility but can still deliver a few pips that traders can profit from.

Typical Price Action in a News Trade

Every instance of the Economic Calendar shows the currency to be impacted by the news, the date and time of the news release, and the elements described above (consensus, previous, and actual numbers).

Any market surprise (i.e. actual number performs far above or far below expectation or consensus) will produce a tradable event. Usually, an initial spike occurs, indicating the large volume of institutional orders that rush into the market and cause price differentiation. This typically appears as a long candle on the 5-minute and 15-minute charts.

Following this spike, prices reverse as those traders who poured into the market start to exit their positions. The next 1-2 candles on the 5-minute chart display a contrary direction to the initial spike as the price retraces.

The final phase tends to last longer and is usually the price settling in the initial spike’s direction as institutional traders re-enter trades at cheaper prices following the retracement. This scenario shows up as several candles gradually drifting in the direction shown by the initial candle.

Risk Events in News Trades

Trading the news carries some risk because of the rapid and large price moves that could occur. If those moves catch you in the opposite direction, you could be prone to large drawdowns. If you are taking the TFF evaluations and you find yourself on the wrong end of news trades, you will be risking disqualification for violating the Maximum Daily or Overall Loss rules. So you must know what these risk events are.

a) Slippage

Slippage occurs when a trader’s orders are not filled due to a sudden, significant change in price. Slippage can affect stop-loss orders or entry orders. When stops are affected, it is as if the bottom has fallen off a can, and the trader can suffer a damaging loss only limited to the extent of the slippage. For entry orders, a slippage will result in a bad fill, which sets the position into a highly negative start due to the large spread incurred from the slippage.

The snapshot above shows what can happen when there is slippage. A trader who sets a stop loss that appears within the boxed region will not be filled until the price has fallen to the $100 mark, where the next candle’s open appears. The slippage on this chart is $30, which is substantive given the asset being traded.

Slippage can also appear whenever you see fully painted candles. This has to do with the manner in which price is represented on a candlestick. Sometimes, when you see price ticks and slips in a slippage situation, the candle will still appear to be fully painted.

b) News conflict

News conflict usually occurs in news events that have multiple parameters. Examples are the Non-Farm Payrolls (unemployment rate + employment change), consumer price index, retail sales, durable goods orders, and producer price index (which all have a headline and a core number).

The various parameters must be synchronized to produce a tradable news release. Where there is conflict in the figures (one pointing one way and the other parameter pointing the other way), there will be whipsaws and price choppiness. This can lead to a situation where a stop entry can be triggered, only for the price to retrace and hit the stop loss.

c) Unscripted news releases

Some news releases do not come with any numbers to work with. These are mostly the statements made by central bank chiefs or key players within an industry whose comments create market volatility (e.g., rate statements, press conferences by central bank chiefs, or the Jackson-Hole Symposium). It also includes political events such as elections or testimony before a legislative panel by the heads of key institutions such as a central bank (e.g., inflation report hearings in the UK).

Since there are no numbers to trade with, traders must try to make sense of the comments and the direction in which those comments will push a currency pair. It is a bit like rowing a boat in stormy waters with no defined wave or directional current.

Conclusion

News trading requires some level of experience to pull off successfully. You can also see that there

are typical and atypical news trade scenarios, and there is no way to accurately predict how institutional

traders would interpret and react to the news.

It is suggested to do some news trading on a small live account, and gradually step up to a larger account as you gain more experience. News trading is what drives the markets and provides the best market opportunities. True Forex Funds is one of the few prop firms out there that permits news trading. Register for TFF’s evaluation programs to get a chance to take advantage of enhanced capital to trade and profit from the news.